Compare the advantages and disadvantages of various retirement savings plans using spreadsheets and other technology.

Clarifications

Clarification 1: Instruction includes weighing options based on salary and retirement plans from different potential employers.Clarification 2: Instruction includes understanding the need to build one’s own retirement plan when starting a business.

General Information

Subject Area: Mathematics (B.E.S.T.)

Grade: 912

Strand: Financial Literacy

Standard: Describe the advantages and disadvantages of financial and investment plans, including insurances.

Date Adopted or Revised: 08/20

Status: State Board Approved

Benchmark Instructional Guide

Connecting Benchmarks/Horizontal Alignment

Terms from the K-12 Glossary

Vertical Alignment

Previous Benchmarks

Next Benchmarks

Purpose and Instructional Strategies

In Math for Data and Financial Literacy, students determine which retirement savings plan would be most advantageous (MTR.4.1).- Students should have an understanding of the different types of retirement savings plans, such as pension plans and 401ks. Students should also explore additional retirement options, such as 403b and Individual Retirement Accounts (IRAs). Instruction includes the advantages and disadvantages of each type of plan.

- Instruction includes analyzing different employers and deciding the best option based on salary and retirement plans.

- For example, provide situations where both options (pension vs. 401k, both with employer contributions and without) are available and the salary is different. Students should be able to compare and justify the long-term advantages and disadvantages of both.

- Using technology, such as a spreadsheet, students should be able to calculate the long-term contributions given a variety of scenarios.

- Students understand the importance of having a retirement plan when self-employed. Students should compare the advantages and disadvantages of Traditional or Roth IRAs, Solo 401k, Self-employed people (SEP) IRA, Simple IRA or Defined Benefit Plan.

- For example, provide examples showing the long-term effects of having a retirement savings plan versus not having one. What are the financial repercussions?

Common Misconceptions or Errors

- Students may misinterpret the information and determine that one employer is a better option; however, in the long run one would have to work longer.

- Students may input data incorrectly into the spreadsheet and not see the overall contributions to a retirement account.

Instructional Tasks

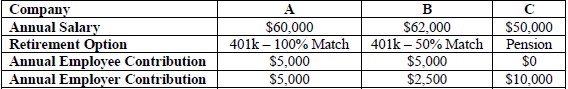

Instructional Task 1 (MTR.4.1, MTR.7.1)- Jake just finished his degree and is applying for jobs. He receives three different offers and is looking at the retirement plans as one of the deciding factors. Based on the following chart, explain the advantages and disadvantages of each. Then explain which one he should choose and why.

Instructional Items

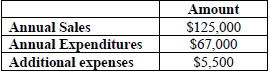

Instructional Item- John has decided to start his own business and wants to start his retirement account. Select the best option based on this salary and explain why.a. Traditional IRA -$6000 per year maximum

b. Solo 401k -$19,500 per year maximum

c. SEP IRA -$31,250

d. Simple IRA -$14,000

*The strategies, tasks and items included in the B1G-M are examples and should not be considered comprehensive.

Related Courses

This benchmark is part of these courses.

1200388: Mathematics for Data and Financial Literacy Honors (Specifically in versions: 2022 - 2024, 2024 and beyond (current))

1200384: Mathematics for Data and Financial Literacy (Specifically in versions: 2022 - 2024, 2024 and beyond (current))

Related Access Points

Alternate version of this benchmark for students with significant cognitive disabilities.

MA.912.FL.4.AP.3: List the advantages and disadvantages of having a retirement savings plan.

Related Resources

Vetted resources educators can use to teach the concepts and skills in this benchmark.

Student Resources

Vetted resources students can use to learn the concepts and skills in this benchmark.

Parent Resources

Vetted resources caregivers can use to help students learn the concepts and skills in this benchmark.