Calculate and compare various options, deductibles and fees for various types of insurance policies using spreadsheets and other technology.

Clarifications

Clarification 1: Insurances include medical, car, homeowners, life and rental car.Clarification 2: Instruction includes types of insurance for a business and for an individual.

General Information

Subject Area: Mathematics (B.E.S.T.)

Grade: 912

Strand: Financial Literacy

Standard: Describe the advantages and disadvantages of financial and investment plans, including insurances.

Date Adopted or Revised: 08/20

Status: State Board Approved

Benchmark Instructional Guide

Connecting Benchmarks/Horizontal Alignment

Terms from the K-12 Glossary

- Rate

Vertical Alignment

Previous Benchmarks

Next Benchmarks

Purpose and Instructional Strategies

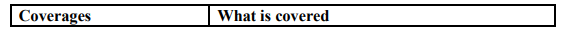

In Math for Data and Financial Literacy, students analyze options for different types of insurance such as medical, car, homeowner’s and life.- Auto Insurance

There are different factors that can affect an insurance premium, such as deductible, vehicle, mileage, driving history and personal information (i.e., age, sex, etc.). Students should consider this when comparing different options. There are also different requirements by state. Students should be able to identify the coverage needed based on the state where the car will be used (MTR.7.1).

- Instruction includes calculating deductibles for each type of car insurance to determine the coverage needed. Students should also be able to determine when the deductible is applied and why (MTR.4.1).

- For example, using situations where there is damage to the car, calculate the deductible (technology: calculator). Sam is in a car accident and there is $5,600 worth of damage to his car. His deductible is $1,000. Explain how much he would pay versus how much his insurance will pay (MTR.5.1).

- For example, using situations where there was property damage, calculate the deductible (technology: calculator). Billy’s car insurance policy covers $25,000 for personal property liability. He is involved in a car accident. There is $7,000 damage caused to the other vehicle and $2,300 damage caused to ancillary items, such as a mailbox or yard items. How much does Billy have to pay out of pocket to cover the damages?

- For example, using situations where there were injuries to passengers and damage to property (technology: calculator). Sidney has a policy which covers $50,000 PD, $50,000 PIP and 50/150 BI. She is involved in an accident with an SUV. There are 3 people injured in the SUV and 2 people injured in her car. The total medical bill for all involved is $43,788. How much will Sidney need to pay out of pocket?

- When analyzing auto insurance, instruction includes analyzing the relationships between coverage limits, deductibles and premiums. Develop understanding of the inverse relationship between the deductible and premium, as well as other factors that may contribute to the cost of insurance, including car rentals.

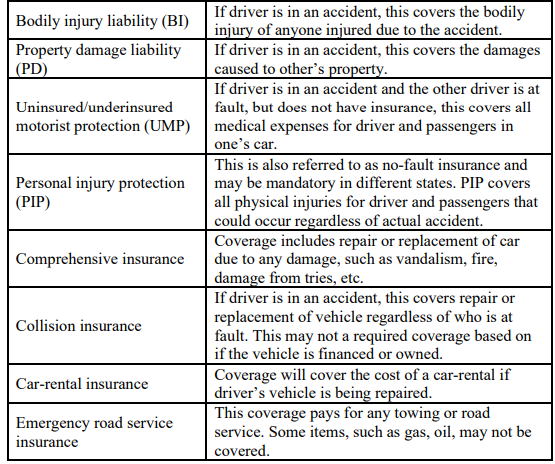

- For example, analyze the two situations where the PIP and Collision

c

overage is the same, but the premium is different.

(MTR.5.1)

- Both were involved in a car accident where there was $490 worth of property damage and $600 worth of damage to the car, which insurance is a better option and why?

- For example, analyze the two situations where the PIP and Collision

c

overage is the same, but the premium is different.

(MTR.5.1)

- Develop understanding of different options when paying premium.

- For example, paying monthly may include a surcharge on the premium. If the premium is paid for the entire year, it is $1,400. If it is paid monthly, each month the insurer pays $125. Which is a better option and why?

- Health Insurance

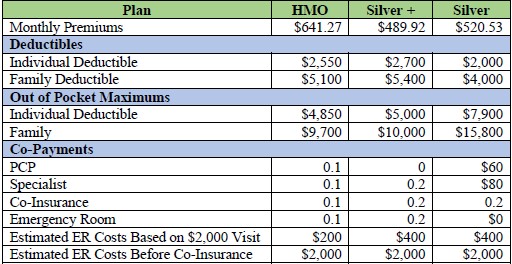

When analyzing health insurance, instruction will include the various costs associated with having health insurance and the different plans available, as well as out of pocket expenses and deductibles based on the premium (MTR.7.1).

- For example, compare the different types of insurance and which is a better option based on a variety of situations:

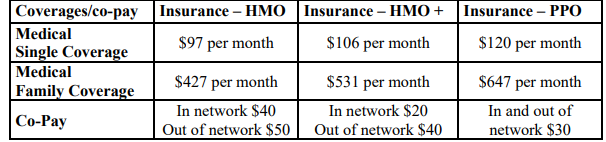

- Using the chart below, determine and explain which policy would be best for the scenarios described.

- Scenario A

Jose selects the Insurance A for himself. During the year, he visits six in-network doctors and two out-of-network doctors. Did Jose select the correct insurance premium?

- Scenario B

If Sam needs to visit an out-of-network doctor 15 times in one year, which plan would be the most financially advantageous and why?

- Scenario C

Paul signed his family up for HMO +. At the end of the year, they had 12 in-network visits and 10 out-of-network visits. Was this the best choice for Paul? Explain why you made this choice.

- When analyzing health insurance, instruction includes the cost covered by employers versus the cost covered by employees. Students will also be able to determine how much is deducted from paychecks. Students can use either a calculator or spreadsheet to help find the post. When using a spreadsheet, students should be able to determine the formulas for each cell.

- For example, in Selena’s new job, the health insurance premium being offered is $627 per month. Her employer agrees to pay 80%. How much will be deducted monthly from Selena’s paycheck to cover her portion of health insurance? How much would be deducted if she gets paid every other week?

- Instruction includes additional charges and deductibles, such as hospital stay, emergency room fees, etc.

- Students will be able to determine if vision and/or dental are needed coverages. Insurance is offered as three different categories: Medical, Dental and Vision. Employees are able to select if they want one or a combination of the three. When evaluating dental and vision, students should be able to analyze the options, similar to medical, and decide which the best option is.

- When providing instruction on health insurance, students should be able to see the difference between a plan provided by an employer versus an individual plan. Instruction includes an analysis of the difference and similarities between insurance plans including deductibles and premiums.

- Homeowner’s Insurance

Students should be able to compare renters and homeowners' insurance and when each is needed.

- Renter’s Insurance

Within this benchmark, students should understand why it would be important to have Renter’s insurance. Present students with scenarios to determine the coverage needed when renting a property (MTR.7.1).

- Homeowner’s Insurance

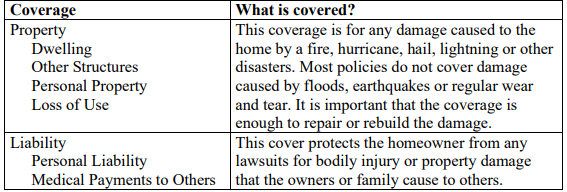

Students should know and understand the different coverages needed as a homeowner. Instruction includes what homeowner’s insurance covers, such as interior damage, exterior damage, loss or damage of personal assets, and injuries that may arise on the property (MTR.7.1).

- Provide scenarios where students need to determine the amount of coverage needed based on the house and property values.

- For example, the Johnson family purchases a home for $354,000. Based on this, how much coverage do they need to ensure they have on their home?

- Life Insurance

- When analyzing life insurance, instruction includes knowing the differences between term-and whole-life plans, as well as determining the premiums and coverage and which is the best option.

- Students should be able to identify the best life insurance based on their different phases of life. For example, as a college student versus as a married couple versus with a family.

- Instruction should include plans that are provided by employers and individual plans. Students should be able to determine when additional insurance may be needed and why.

- When using spreadsheet technology for analysis, multiple problems can develop as students create and enter formulas for calculations. Note that many programs require a * symbol to denote multiplication. Placing two variables (or cells) side by side may generate a REF error.

Common Misconceptions or Errors

- When comparing different insurances premiums, look for students who may select one as more financially beneficial without considering the deductible.

- When deciding which car insurance premiums, look for students who may select a premium that will not cover what they need based on different scenarios.

- When analyzing premiums and coverages, look for students who do not consider all the coverages and may select a cheaper option. Help students understand the importance of truly getting the coverage needed for life circumstances.

- Previously students have used spreadsheets and other technology to help calculate math problems, look for students who may input the information incorrectly into the spreadsheet and/or technology.

Instructional Tasks

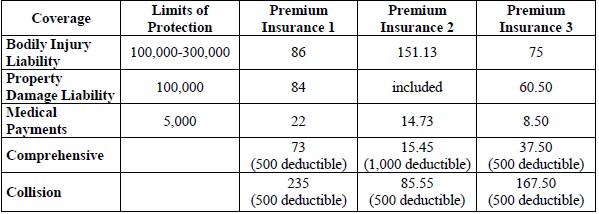

Instructional Task 1 (MTR.7.1)- Joey is trying to decide which car insurance policy is the best option. He receives three quotes from different insurance companies (6-month premium).

- Using technology, determine which Insurance company would be the best option and explain why.

Instructional Task 2 (MTR.7.1)

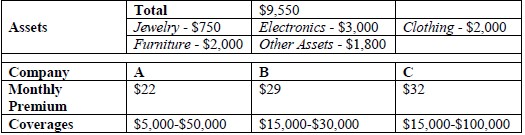

- Susan is renting her first apartment and is considering renter’s insurance. She receives quotes from several companies, which she puts in a spreadsheet along with her assets.

- Part A. Based on the numbers provided, which company would be the best option?

- Part B. If there is a robbery, and all the jewelry is stolen, is it beneficial to submit an insurance claim or pay out of pocket?

Instructional Items

Instructional Item 1- When selecting a health insurance premium, based on the chart below, explain which plan would be the least favorable and explain why.

*The strategies, tasks and items included in the B1G-M are examples and should not be considered comprehensive.

Related Courses

This benchmark is part of these courses.

1200388: Mathematics for Data and Financial Literacy Honors (Specifically in versions: 2022 - 2024, 2024 and beyond (current))

1200384: Mathematics for Data and Financial Literacy (Specifically in versions: 2022 - 2024, 2024 and beyond (current))

7912120: Access Mathematics for Data and Financial Literacy (Specifically in versions: 2022 - 2023, 2023 and beyond (current))

Related Access Points

Alternate version of this benchmark for students with significant cognitive disabilities.

MA.912.FL.4.AP.1: Compare various options, deductibles and fees for various types of individual insurance policies, such as medical, car and/or homeowners’ insurance.

Related Resources

Vetted resources educators can use to teach the concepts and skills in this benchmark.

Lesson Plan

STEM Lessons - Model Eliciting Activity

Select a Healthcare Plan:

Students are asked to determine a procedure for ranking healthcare plans based on their assumptions and the cost of each plan given as a function. Then, they are asked to revise their ranking based on a new set of data.

Student Resources

Vetted resources students can use to learn the concepts and skills in this benchmark.

Parent Resources

Vetted resources caregivers can use to help students learn the concepts and skills in this benchmark.