General Information

Subject Area: Mathematics (B.E.S.T.)

Grade: 912

Strand: Financial Literacy

Date Adopted or Revised: 08/20

Status: State Board Approved

Benchmark Instructional Guide

Connecting Benchmarks/Horizontal Alignment

Terms from the K-12 Glossary

- Simple Interest

Vertical Alignment

Previous Benchmarks

Next Benchmarks

Purpose and Instructional Strategies

In grade 7, students solved problems involving simple interest. In Algebra I, students explain the relationship between simple interest and linear growth and the relationship between compound interest and exponential growth. In later courses, students will extend this to include continuously compounded interest.- In MA.912.FL.3.2, students became familiar with simple and compound interest and how to use the formulas for each to solve real-world problems. In this benchmark, students will make connections between simple interest and linear growth and between compound interest and exponential growth. To help students discover this relationship, consider guiding them to form a table.

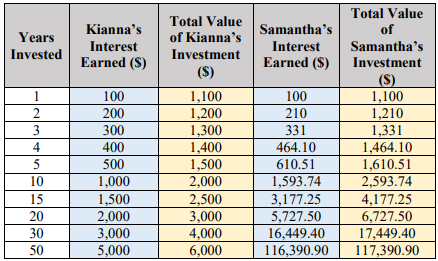

- For example, Kianna and Samantha both receive $1,000 cash from graduation gifts from family and friends. They each decide to invest their money in an investment account. Kianna’s investment earns 10% in simple interest. Samantha’s investment earns 10% in compound interest annually. Guide students to create the interest formulas below and use them to create the table below to compare the growth of their investments over time.

- Kianna’s Interest Earned would be represented by = 1000 · 0.1 · .

- Kianna’s Total Value would be represented by = 1000(1 + 0.1).

- Samantha’s Interest Earned would be represented by = 1000(1 + 0.1) − 1000.

- Samantha’s Total Value would be represented by = 1000(1 + 0.1)

- For example, Kianna and Samantha both receive $1,000 cash from graduation gifts from family and friends. They each decide to invest their money in an investment account. Kianna’s investment earns 10% in simple interest. Samantha’s investment earns 10% in compound interest annually. Guide students to create the interest formulas below and use them to create the table below to compare the growth of their investments over time.

- Once completed, ask students what relationships they observe in the behavior of Kianna’s versus Samantha’s investment. Students should quickly discover Kianna’s investment exhibits linear growth while Samantha’s shows exponential growth.

- Solidify this understanding by having students graph the two functions that represent the total value of the two investments.

- Once students make this discovery, begin a conversation with them about which type of interest would be more advantageous for long-term investments. Take this opportunity to make connection to MA.912.F.1.6 (i.e., What if Kianna received $10,000 in gifts? Would the simple interest account be a better investing tool?).

- Remember the expectation for this benchmark is for students to explain why these relationships occur. Be sure to discuss the equations formed and that the variation of years is used as a factor in the simple interest formula and as an exponent in the compound interest formula. .

Common Misconceptions or Errors

- When forming compound interest equations, students sometimes forget to convert the interest rate from a percent value to a decimal value before substituting it into the formula.

Strategies to Support Tiered Instruction

- Instruction includes making the connection to determining linear and exponential functions (MA.912.F.1.8) from a financial context.

- For students who need extra support in converting a percentage to a decimal, instruction includes students thinking about percent as “per one-hundred.”

- For example, when writing 8% as a decimal, ask “8% is how many per 100?” Then write 8% = 8/100 which is equivalent to 0.08.

Instructional Tasks

Instructional Task 1 (MTR.3.1, MTR.4.1, MTR.5.1, MTR.7.1)- Phoenix invests in a savings account that applies simple interest.

- Part A. How will her investment grow, linearly or exponentially? Justify your answer.

- Part B. If Phoenix invests $725 and earns an annual rate of 4.2%, write an equation that would represent the total amount she would have at the end of each year.

- Part C. How long will it take for her initial investment to double?

- Part D. If instead the savings account had interest at the same rate but was compounded annually, how much money would she have after the amount of time found in Part C?

Instructional Items

Instructional Item 1- Trevarius invests in a savings account that applies compound interest annually. How will his investment grow, linearly or exponentially? Justify your answer.